CMA Course in Dubai

The CMA is the globally recognized, advanced-level credential appropriate for accountants and financial professionals in the business. Achieving the CMA demonstrates your professional expertise in financial planning, analysis, control, decision support, and professional ethics – skills that are in demand by organizations around the world.

Whether you want to enhance the value you bring to your current position, or expand your career potential, the CMA Course in Dubai will help you set the standard for professional excellence.

The role of a CMA is an important asset in all types of organizations. They analyze operating results, review performance, audit operations, and resolve issues that enhance the strategic objectives of the organization. CMAs appreciate the business approach for managing customer value, formulating strategies, and valuing equity. CMAs are value creators, not just merely accountants who adhere to compliance with the profession.

How many papers/parts and how long can it take to become a CMA?

- Consisting of 2 parts, Part 1 and Part 2

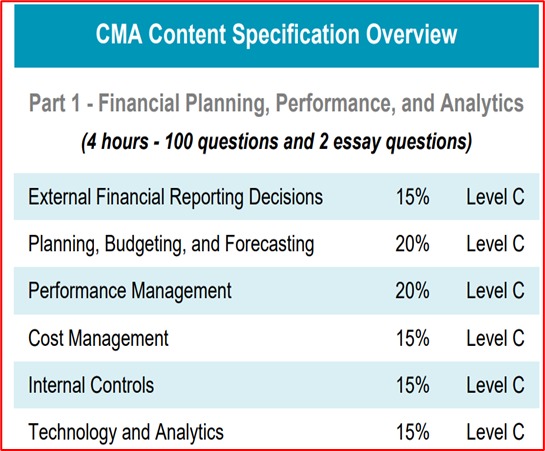

- Part 1-Financial Planning, Performance and Analysis-20 Chapters

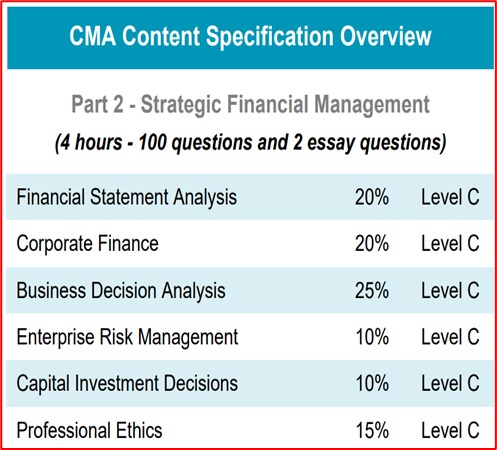

- Part 2- Strategic Financial Management-15 Chapters

- Take Part 1 and Part 2 in any order.

- You can complete and earn your CMA qualification in 8-10 months’ time.

Part 1 – Financial Reporting, Planning Performance, and Control

Part 2 – Financial Decision Making

Who Should Attend CMA Course in Dubai:

- Financial Controllers

- Finance and Accounting professionals

- Finance Managers

- Chief Accountants

- Financial Analysts

- Non-finance Managers

- Fresh Graduates willing to enter into the finance & accounting field

Eligibility Criteria for Admission:

- You can take the exams before graduating.

- Bachelor’s degree from an accredited college or university (in any major), within 3 years of passing.

- 2 years of professional working experience

- ACCA is also eligible.

You can master in:

- Planning and Analysis

- Technology and Analytics

- Performance Management

- Risk Management and Internal Controls